Tax season is coming soon, and I’m sure you’re looking for small business accounting tips that will help you avoid penalties.

Or maybe you just want to learn the ropes. Statistics by Finances Online show that 21% of SMB (small and medium-sized business) owners are not knowledgeable enough about accounting and that they still use traditional pen-and-paper to track their finances.

But what does accounting do for a company anyway, and why is it important?

Accounting is responsible for interpreting, classifying, analyzing, reporting and summarizing financial data. These include:

- Showing whether you made a profit or experienced loss (aka income statement)

- Listing your company assets, liabilities, and equities on a particular date (aka balance sheet)

- Reporting money generated and money spent in a specific period of time (aka cash flow statement)

Tracking company income and expenditure helps you make business decisions by providing relevant financial information to your investors, management, and government.

With that said, here are 10 SMALL BUSINESS ACCOUNTING TIPS to save time and money (and sanity!)

Read them below:

1. YOU NEED AN ACCOUNTANT!

Even small businesses need a helping hand in managing their finances, so if you can’t afford to hire one yet, you should at least consult one. Nothing beats an actual professional who studied years and took the CPA to become a certified (and qualified) accountant.

Acquiring an accountant’s services can:

- Maximize deductions when filing tax returns

- Create financial reports to avoid audits (or financial inspection)

- Calculate financial implications from expenses

- Help small businesses plan for the future with financial advice

For the most part, accountants can also function as bookkeepers (record financial transactions), so hiring them for your small business is a recommended asset to invest in.

2. SEPARATE WORK AND PERSONAL FINANCES

Don’t mix business with pleasure! You have to categorize transactions that are work-related and private use into different categories. Start by having a dedicated business bank account and a different bank account for personal finances.

After you register and fully set up your small business in the Philippines, your income needs a designated bank account. From there, you can view all of your transactions that are exclusively business-related. In tax season, life will be much easier for your accounting.

Here’s what you can start doing:

- Do your research! Before opening any accounts, look at different banks and compare different package pricing. Business accounts tend to cost more than personal banking, so take those into consideration.

- A business bank account requires an official business name that is registered where you are situated. Ask the banks you’re interested in for the required documents to apply before setting any appointments.

- Once you have the program of your choice, open a checking and savings account at that bank.

- Having multiple savings accounts help to organize funds and plan taxes for different purposes.

- Determine the need for a business credit card to start building credit (when your small business grows, you’ll be legally required to have a business credit card to separate from personal assets).

It’s worth noting that while small businesses are usually sole proprietors and don’t legally require a business bank account, we still highly recommend that you have one. Especially when the aim is to eventually grow into a big LLC, partnership or corporation, having a separate account for your company will be required by law.

3. CATEGORIZE YOUR ACCOUNTS LIKE A PRO

Having a business bank account is one thing, but when it comes to actual accounting there’s a lot more “accounts” (or books) involved, each serving their own purpose.

In fact, we have summarized the 10 accounts for small businesses you should pay attention to and track:

- Cash – business transactions that involve collecting receipts and disbursements

- Accounts Receivable – aka invoices, or records of money expected to come from customers

- Inventory – recorded number of unsold products

- Accounts Payable – outgoing bills to maintain the business like rent, internet, phone, electricity, and water

- Loans Payable – due dates and payments of money borrowed for expenses required to operate your business

- Sales – aka incoming revenue, this is the amount of money that you have received from your “Accounts Receivable”

- Purchases – raw materials or goods used for your business. This account is used to calculate your company’s gross profit (Revenue – Cost Of Goods Sold = Gross Profit)

- Payroll Expenses – considered as the biggest cost, this is the money you pay your employees every period

- Owners Equity – aka net assets, or the amount that the business owner has once liabilities are deducted from assets

- Retained Earnings – company profit that is reinvested in the business, so it appears like the running total that the company has retained since it began.

4. TRACK YOUR EXPENSES

As we suggested in the previous point, there are at least 10 accounts that even small businesses need to keep track of, that’s why it’s crucial that your accounting should dedicate the time to perform regular checkups.

There are 2 ways to record expenses – cash or accrual basis. The cash basis is a bookkeeping method of recording revenue and expenses when receipt or payment is made. Whereas accrual basis records revenue and expenses when the transaction occurs, with or without the payment made. This method requires tracking receivables and payables.

Ensuring that all accounts (or books) are up-to-date and accurate. You can start by building the following habits in accounting:

- Check your transactions daily and do a thorough inspection weekly to total your figures.

- Maintain your inventory up-to-date by recording incoming and outgoing transactions as they come and go.

- Keeping receipts (both online and printed) and organize them in a folder with labels or if you want to go paperless, have them scanned to your computer and added to your accounting database.

- Track expenses through online banking and credit card records.

- Follow-up with banks if there are any bounced checks,

- Or with customers with pending and overdue invoices.

5. CREATE ACCURATE INVOICES

We’ve already mentioned invoices in this article at least twice, but new business owners may be unfamiliar with the concept. Accurate invoicing is about writing specific transaction details for clients to make their payment on time. These go to your “Accounts Receivable” book, where you can track business cash flow and late payments.

Improve your invoices by:

- Using templates suitable for your business type

- Add the correct information (company, customer, and bank), pricing, mode of payment, the payment plan and most of all, deadlines

- Considering digital and online payments as a mode of payment to reduce paper receipts and keep organized.

- Avoiding multiple versions of the invoice once it has been finalized between you and your customer. Otherwise, you may end up confused with keeping records in accounting.

6. SPECIFY YOUR MODE OF PAYMENT

You’ve got the accurate invoices down. When you start making sales, make it simple for your customers to make the purchase.

Depending on your platform, there are different options to choose from, such as when to use cash or if your small business also has an online store (which you should, by the way!).

Here are some methods and their advantages:

- Cash – common and direct, payment using bills and coins in exchange for a printed receipt, can be transferred and deposited in the bank or sent through remittance.

- Check (or cheque) – a bank order to release a specified amount of money to the person mentioned in the cheque. This is the safest because carrying cash is not required.

- Digital – the use of e-Wallet applications or platforms are usually integrated with bank accounts or prepaid to deposit money. This is the most convenient since no physical exchange needs to be done and transactions are recorded within the system. We’ve previously talked about how to set up PayPal, but there are other options available such as GCash, DragonPay, Coins.ph, PayMaya, and PayMongo.

7. INVEST IN ACCOUNTING SOFTWARE

We still mean when we said you need an accountant to crunch your business numbers. Although, if you’re looking to cut costs and you got the ropes of accounting, then consider putting your money into cloud-based accounting software.

Why?

- Automate your transactions by syncing software with you bank account

- Cloud-based saves backups to avoid data loss

- No more pen-and-paper or offline spreadsheets

- File tax returns online and more accurately (compared to traditional accounting)

- Manage inventory electronically

- View summary reports of your income statement and balance sheets

- Choose between different software packages or have one customized to your needs

8. KNOW AND MEET ALL YOUR DEADLINES

Your “Accounts Payable” includes regular maintenance fees like rent, electricity, water, and other utilities (internet and phone). Depending on your agreement with your landlord, or current setup, these bills are usually charged monthly.

Tax season in the Philippines is due every year on April 15, and failure to meet deadlines results in penalties such as a 25% tax surcharge and an interest of 12% per annum from the deadline before full payment of the sum.

What you can do to stay on top of deadlines:

- Record all of your due dates and list them in order of urgency and priority

- Set reminders using a countdown or timer on your accounting software or phone

- Allocate a budget for each bill so before the due date comes, you’d have enough to make the payment

- Fill tax returns accurately and submit them earlier than the deadline to give allowance for revisions, just in case.

9. REVIEW YOUR RECORDS EVERY QUARTER

Besides tracking your expenses, you should look at all of your records in-depth at the end of each quarter. You can do this yourself, or with the help of your accountant and/or accounting software.

The review should provide the following information:

- Trends in growing or declining sales

- Year-over-year revenue

- Late customer payments

These will be used to create forecasts for your small business’ future financial projection, whether it’s time for an upgrade or to cut costs in equipment, office space, etc.

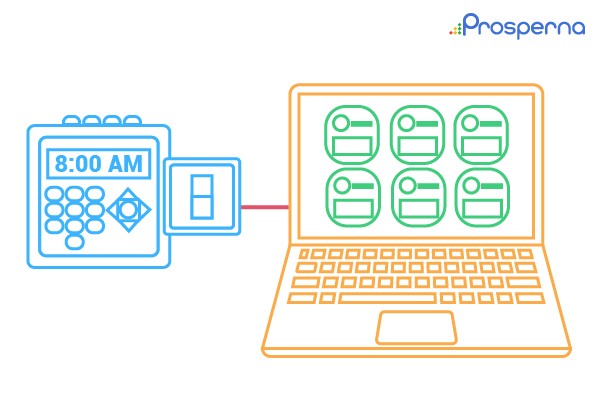

10. MONITOR YOUR EMPLOYEES

Keep tabs on your employees on your “payroll expenses” account. Considering labor costs as the biggest expense in your small business, save yourself the hassle of underpaying and overpaying your staff.

Technology provides the solution to traditional operations, including:

- Cloud-based time tracking software for employees to clock in and out of the office, using their smartphones, tablets, and computers.

- Track employee activity such as overtime, tardies, leaves, etc. based on the online Bundy clock.

- Record income accurately for every employee since all their activities are recorded in the system.

- Integrate accounting software to your tracking and payroll system.

- Distribution of salary can be made easier since your business bank account is connected to your payroll system.

- Automate mandatory deductions and record taxable income, where applicable, through online payslips.

CONCLUSION

For growing businesses like yours, failure to meet deadlines and miscalculated tax will cost you a LOT of money.

So, take these 10 small business accounting tips to heart and practice responsible bookkeeping for your company. Remember:

- You need an accountant!

- Separate work and personal finances

- Categorize your accounts like a pro

- Track your expenses cautiously

- Create accurate invoices

- Specify your mode of payment

- Invest in accounting software

- Know and meet your deadlines

- Review your records every quarter

- Monitor your employees

At Prosperna, we focus on helping small businesses and the MSME industry in the Philippines become successful, using our Customer-First marketing and sales engine.

Learn more about growing your small company by subscribing to our blog or by booking a FREE DEMO with us.

Dennis Velasco

Technology Evangelist super passionate about helping the industries of eCommerce, SMEs and real estate in the Philippines reach new levels of success.